Introduction

Our client, a leading global e-commerce marketplace, has been steadily expanding their business while supporting a growing array of customers – including small to medium businesses, online merchants, and individuals.

In this case study, we focus on how our client sought to enhance their payout capabilities for its customers, particularly in the ASEAN countries. The company aimed to provide a cost-effective and efficient solution for cross-border fund transfers to bank accounts and mobile wallets. To achieve this goal, the company partnered with TerraPay.

The Challenge

Expensive payouts

The high cost of moving money across borders is one of the biggest barriers, especially for small-value transactions. To enable seamless and cost-effective money movement, it was necessary to overcome challenges like expensive transaction and high FX rates

Lack of visibility & monitoring

As a tech company, our client is highly data-driven and was on the look-out for a partner who can meet & exceed their unique data requirements and offer visibility and ease in terms of monitoring critical transaction data

Complex & time-consuming payment processes

Meeting the stringent compliance and regulation requirements of individual banks & regions was not only becoming a mammoth operational task but also resulting in delayed payments

Diving deeper into our client’s payment needs, TerraPay identified that the e-commerce giant wanted to bring transparency, simplicity, security, and agility into an otherwise obscure and complex world of payments.

Why TerraPay

Our partnership with the e-commerce company is rooted firmly in meaningful collaboration, trust, and communication to drive success. While we became the partner of choice for our client because of our strong payment infrastructure, expanding network, and unmatched compliance capabilities, our ability & willingness to truly ‘collaborate to innovate’ and simplify payments for our client became a key differentiator.

- Our ability to customise the payout experience using diverse functionalities to offer the payees their preferred payout methods in their local currency

- Built-in compliance management specific to each country, each region

- Sending multiple and secure payouts such as fund disbursement to employees, sub-merchants, suppliers or customers

- Payouts to bank accounts & wallets & cards – across the globe

- Seamlessly integrating with TerraPay’s single API connects partners to our suite of global payment solutions and network of 140+ payout countries.

- As the only fintech with 31+ licenses & regulatory approvals, TerraPay handles complex regulatory compliance and develops agile routes to ensure safe, fast, and reliable access to an ever-expanding global financial ecosystem

The Solution

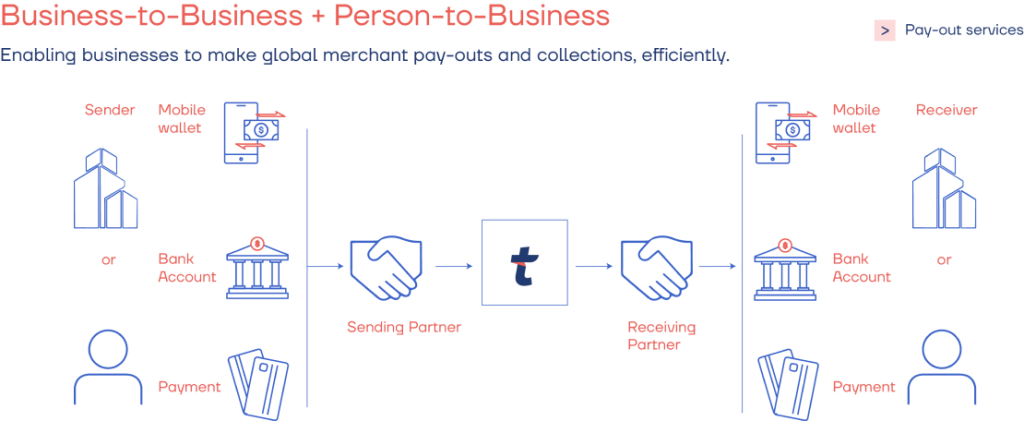

For a transaction to be completed, the following steps need to be taken

- Validate the beneficiary using the View Account Status API

- Create a quotation using the ‘create quotation’ API for applying the FX rate and rounding off rules

- Initiate a transaction using the ‘create transaction’ API to submit the transaction along with the sender and beneficiary KYC details

The Result

Through TerraPay’s comprehensive and customised solution, several key aspects were identified and addressed, providing significant improvements in terms of success rates and compliance processes, benefiting our client and their customers.

Success rate

Working together with our client, we identified success rate issues related to a specific destination partner in a major corridor. Using data analysis and maintaining constant engagement, helped us leverage our intelligent transaction routing capabilities to successfully improve the aggregate success rates from 86.9% in January to an impressive 99.0% in April for that corridor.

Whitelisting

We collaborated closely with our client to whitelist some of its largest merchants. This proactive approach significantly reduced compliance requests, decreasing the average number of RFIs from 225 in Q1 of 2023 to only a single query in April and May. As a result, operations were streamlined and enhanced efficiency in complying with regulatory requirements.

Custom reporting

Meeting our data-driven client’s unique needs meant constantly pushing the boundaries of technology and developing tailor-made solutions, like hyper-customised reporting that creates room for swift, automated action, offers increased transparency, allows real-time monitoring, and challenges inefficiencies with accurate solutions – all under a single unified dashboard.

Treasury capabilities

TerraPay’s treasury team took on an active role in pre-funding the partner banks. By managing the pre-funding process, we shouldered the responsibility of ensuring funds availability. This empowered our client partners to focus on managing their core business operations while relying on TerraPay for seamless payment management.

Driven by collaboration

Understanding the unique requirements of our client was not only the key to delivering the results they desired but also, adding value as their partners. While we have our standardised processes in place, this enabled us to customise our solutions and foster a strong partnership with our client.

Our ability to tap into our existing global network of banks and mobile wallets while also expanding to add new partners has always helped us meet our larger mission of building a connected payments ecosystem while enabling simple, seamless, and secure payments for our partners.

Since the beginning of this partnership, TerraPay has successfully delivered over a million transactions per month. This achievement not only demonstrates TerraPay’s scalability and reliability but also adds tremendous value to the company’s customers. By offering seamless cross-border payout capabilities, the company improved its overall user experience, fostering customer satisfaction and loyalty.

99 %

success rate

90 %

transactions delivered in <15 minutes

115 k+

unique receivers, across all leading banks in the region

“We have adopted a proactive strategy of constant engagement with our partner…Our focus has been to assist our client in achieving success by listening to their challenges and seeking their feedback on consistently improving our services.”

99 %

success rate

90 %

transactions delivered in <15 minutes

115 k+

unique receivers, across all leading banks in the region